Impact of Cannabis Licensing on Market Saturation (2018–2025)

In the Beginning…

From 2018 through 2025, the U.S. recreational cannabis industry went from explosive growth to a period of market correction. One of the most debated factors in this shift is whether issuing too many business licenses contributed to oversaturation, falling prices, and the failure of many operators.

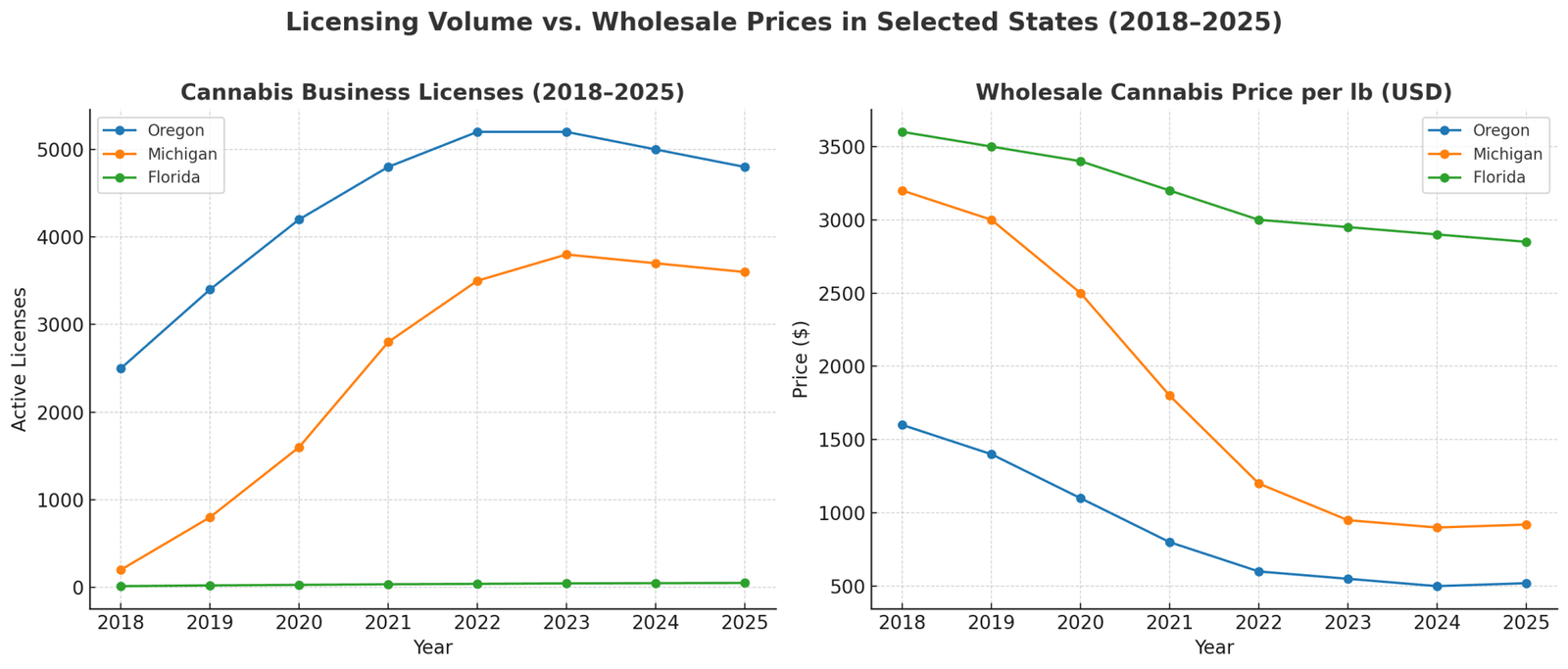

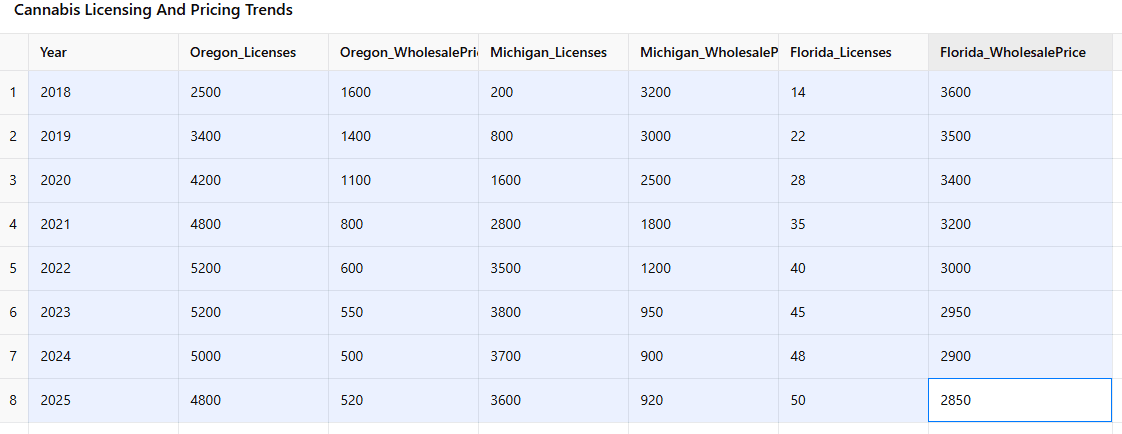

States with open or lightly restricted licensing often saw rapid entry of new cannabis companies, leading to fierce competition for limited demand. By contrast, limited-license states created quasi-oligopolies for a small number of players, avoiding oversupply but raising equity and access concerns. The seven-year window shows clear patterns in how these different approaches played out.

License Caps vs. Open Licensing Approaches

Regulatory frameworks vary widely:

- Open licensing (Oklahoma, Oregon, Michigan early on) allowed almost anyone who met basic qualifications to get a license. This avoided accusations of favoritism but created intense competition.

- Limited licensing (Florida, Illinois, New Jersey) capped the number of operators, protecting margins for incumbents but reducing market access for smaller entrepreneurs.

Oklahoma’s medical cannabis program is a prime example of open access—at one point, roughly 14,000 cannabis business licenses were active. This was politically framed as fairness and inclusivity, but it overwhelmed the market with supply.

By contrast, multi-state operators have favored limited-license states like Florida and Illinois, where fewer competitors means each license holder commands a larger share of sales. These markets avoided the most extreme price collapses, but faced criticism for being closed off to new entrants.

Oversupply and Market Saturation in Unlimited-License States

Where license issuance was liberal, oversupply became a defining problem:

- Oregon allowed unlimited cultivator licenses with no canopy limits. By 2019, regulators reported enough cannabis in the system to meet six years’ worth of demand. Wholesale prices crashed, and many small growers closed.

- Colorado and Washington also hit oversupply after initial growth, prompting temporary freezes on new cultivation licenses.

- Michigan’s adult-use program (launched late 2019) saw over 1.2 million plants in active cultivation by 2022—three times the amount the market could absorb. Prices plunged, and by late 2022–2023, industry leaders openly called for a moratorium on new grow licenses.

Economist Beau Whitney warned that “with the glut of supply, and with so many licenses, it’s setting up businesses for failure.” This oversupply cycle was repeated across multiple states between 2018 and 2023.

2023–2025: Contraction and Stabilization Attempts

By late 2022, the signs of saturation were clear—and the market began to contract:

- National license counts peaked at ~44,300 in late 2022, but dropped to ~38,600 by Q3 2024—a decline of over 11%. In early 2025, active licenses hovered around 38,500, marking the first sustained pullback in the modern cannabis era.

- Oregon extended its moratorium (HB 4016) and further tightened licensing in 2024 to stem oversupply.

- California saw wholesale prices for outdoor cannabis down ~74% from their Q4 2020 peak by early 2025, with thousands of inactive or surrendered licenses.

- Michigan hit record sales in 2024 ($3.29B) but remained oversupplied. Major operators began exiting the state in 2025 due to brutal price competition.

- Washington kept licensing limited, issuing only controlled numbers of new equity licenses in 2025 to avoid Oregon/Michigan-style gluts.

Consequences of Oversaturation (2018–2025)

- Price Collapse & Margin Squeeze

- Wholesale prices in oversupplied states dropped 50–75% from early peaks. Many operators sold below production cost by 2023–2024.

- Consumer prices fell too, but tax and compliance burdens kept legal shops from undercutting illicit sellers enough to win the whole market.

- Business Failures & Consolidation

- 2023–2025 brought waves of closures, mergers, and distressed asset sales.

- In several mature markets (CA, OR, CO, NV), the number of active licenses fell year-over-year for the first time.

- Illicit Market Persistence

- Surplus product often leaked into unregulated channels, especially in California and Oregon. High taxes and regulatory costs kept the black market competitive, undermining legal businesses.

The 2018–2025 data makes it clear: over-licensing in recreational cannabis markets has been a major driver of oversupply, price erosion, and business attrition.

States with unlimited or rapid license issuance—Oregon, Michigan, Oklahoma—saw boom-and-bust cycles that left many operators bankrupt. States with stricter license caps—Florida, Illinois, New Jersey—avoided extreme oversupply but limited opportunities for smaller businesses and equity applicants.

By 2025, the industry is in a stabilization phase: some states have capped or slowed new licenses, markets are consolidating, and prices in a few regions are showing modest rebounds. But the lesson is clear—license policy directly shapes market sustainability in cannabis. Balancing fairness, access, and economic viability remains the challenge going forward.

Downloadable PDF – Impact of Cannabis Licensing on Market