The Market of Intoxicating Hemp Compared to Marijuana

Production, use, and how they actually compete in the market

In this article we will cover the aspect of Hemp vs Marijuana; we’ll look at how the intoxicating hemp market compares to the marijuana intoxication market by focusing on the real production numbers, the scale of each industry, and how each segment fits into the broader cannabinoid economy.

The goal is simply to lay out what each market actually represents, how the products flow from plant to consumer, and where the two industries overlap or differ in everyday use and demand.

The numbers used in this article reflect the most reliable data we can assemble from USDA reports, market-research firms, and industry analyses. Because neither federal nor state agencies directly track every category of intoxicating hemp or marijuana production, some portions rely on modeled estimates built from the closest measurable indicators. All conclusions are based on the best available evidence at the time of writing.

This article walks through the numbers on:

- How much hemp is grown in the U.S. and what fraction can even become intoxicating

- How big the intoxicating hemp market is compared to the full hemp-derived cannabinoid economy

- How much of the marijuana market is truly “recreational” vs medical

- How the two sectors actually interact and compete in the free market

Hemp on the farm: how much can even get you high?

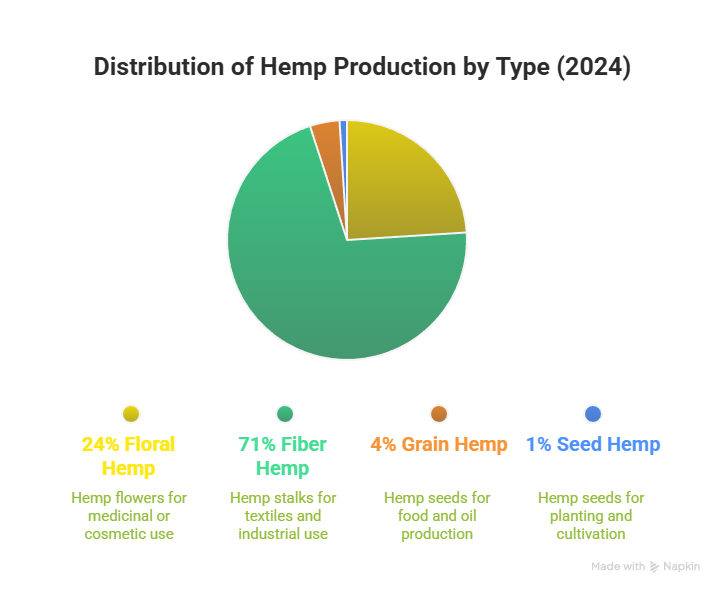

USDA’s National Hemp Reports break U.S. hemp into four main buckets grown in the open:

- Floral (grown for cannabinoids)

- Fiber

- Grain

- Seed

For 2024, USDA reports that U.S. farmers produced:

- 20.8 million pounds of floral hemp

- 60.4 million pounds of fiber hemp

- 3.41 million pounds of grain hemp

- 0.697 million pounds of seed hemp

That is about 85.3 million pounds of hemp biomass grown in the open… with floral hemp accounting for only ~24% of the physical volume and fiber more than 70%. [1]NASS

Only the floral portion can realistically become intoxicating products. Fiber, grain, and seed simply do not contain enough cannabinoids to matter.

So from the very start:

- Roughly three-quarters of U.S. hemp biomass is non-intoxicating by design

- Only one-quarter of biomass is even a candidate for intoxicating or medical cannabinoid products

And that is before we ask what actually happens to that floral biomass after harvest.

The hemp-derived cannabinoid economy: big money, small intoxicating slice

To understand what happens to that floral biomass, we need the demand side.

Total hemp-derived cannabinoid demand

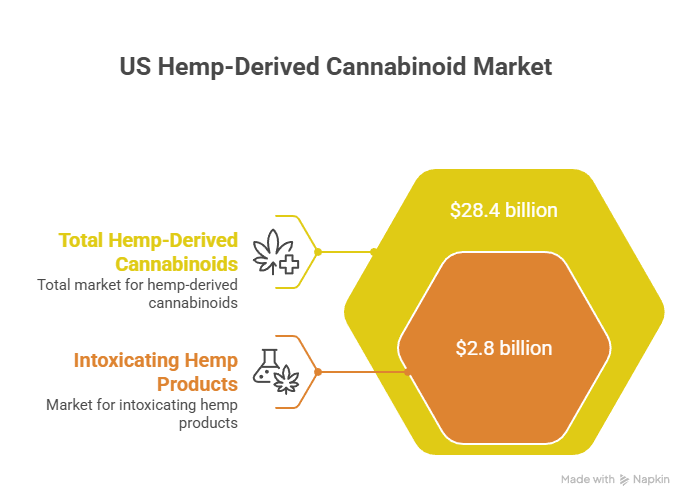

Whitney Economics’ 2023 U.S. National Cannabinoid Report estimates that:

- Total demand for hemp-derived cannabinoids is ≈ $28.4 billion, with a range from $21.3B to $35.8B

- This includes CBD, minor cannabinoids, and intoxicating hemp cannabinoids, across all states and channels

Nationally, the total market for hemp-derived cannabinoids is conservatively estimated to be $28.4 billion. Hemp Supporter+1

That means the cannabinoid products made from a relatively small slice of floral hemp are driving a multi-billion dollar market all by themselves.

Intoxicating hemp’s share of that market

Brightfield Group, via Cannabis Business Times, estimates that the U.S. market for intoxicating hemp-derived cannabinoids (delta-8, other hemp-derived THCs, etc., excluding CBD) grew from $200.5 million in 2020 to nearly $2.8 billion in 2023. [3]Cannabis Business Times

Put beside Whitney’s $28.4B estimate for the whole hemp-derived cannabinoid space, that implies:

Intoxicating hemp products are roughly 10% of total hemp-derived cannabinoid demand by dollars.

And that ~10% is coming out of only the floral portion of the hemp crop.

How much hemp biomass actually goes to intoxicating products?

We still do not have a line-item from USDA that says

“X pounds of hemp became gummies that got people high this year.”

So we have to triangulate.

Floral supply vs cannabinoid demand

USDA says there were 20.8 million pounds of floral hemp in the open in 2024. [1]NASS

At the same time, hemp economists have pointed out that only a small fraction of that floral volume would be needed to satisfy the entire cannabinoid market, given how concentrated modern extraction and isolation are. One critique of USDA’s methodology notes that it would take roughly 1.2 million pounds of flower to service the cannabinoid market at realistic extraction yields, compared to the 20.8 million pounds USDA reports. [4]GreenPharms Arizona

That suggests:

- A large portion of floral hemp is surplus, poorly utilized, or feeding low-value channels

- The entire $28B+ cannabinoid market can be supplied by a relatively small amount of floral biomass

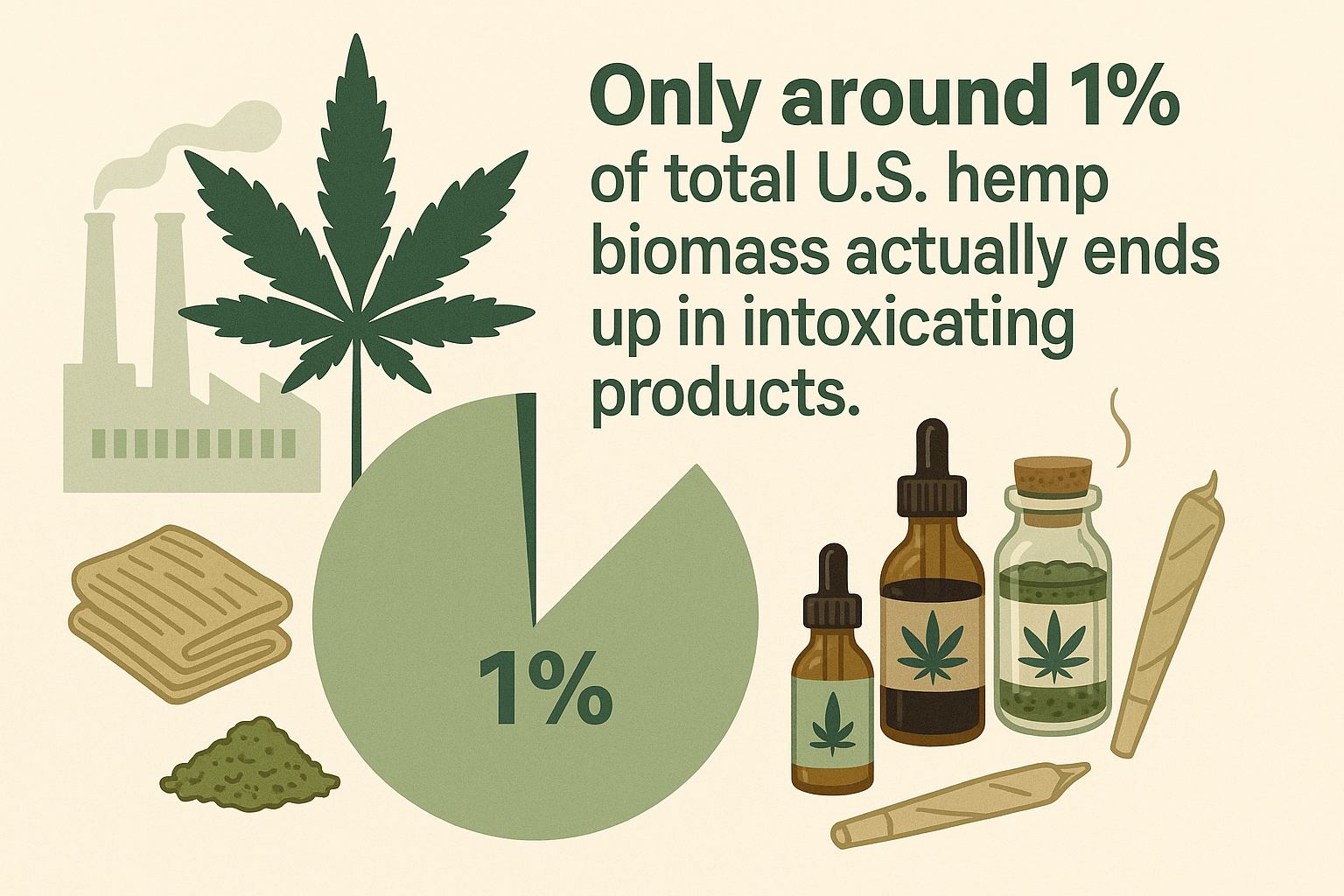

Intoxicating share of floral biomass

We know:

- Total hemp-derived cannabinoid demand ≈ $28.4B [2]Hemp Supporter

- Intoxicating hemp cannabinoids ≈ $2.8B [3]Cannabis Business Times

So intoxicating hemp is about 10% of cannabinoid dollars.

Intoxicating products generally sell at a higher dollar-per-mg of effect than bulk CBD and wellness products. That means intoxicating products likely require less biomass per dollar of sales than CBD does.

If intoxicating hemp is ~10% of sales, a reasonable, conservative read is that:

- Perhaps 3–5% of the floral hemp biomass is actually going into intoxicating products

- Floral itself is only about 24% of total hemp biomass

Multiplying those together gives a rough range:

Only around 1% of total U.S. hemp biomass actually ends up in intoxicating products.

You can argue about the exact number… but it is very hard to stretch these inputs into anything like “hemp is mostly about getting people high.” The overwhelming majority of hemp, in physical terms, is fiber, grain, seed and non-intoxicating cannabinoid production.

Marijuana: a market overwhelmingly driven by intoxication

Now flip to the marijuana side.

Total legal cannabis market size

Recent industry estimates put the U.S. legal cannabis market at around:

- $33.6 billion in 2023 [5]CannabisMD TeleMed

- $31.4 billion in 2024, up 9.1% over 2023, with further growth to $35B+ projected for 2025 [6]Flowhub+1

So, at a high level, legal cannabis (mostly marijuana) is roughly a 30-plus-billion dollar business in the U.S., separate from hemp.

Recreational vs medical shares

Grand View Research reports that in the U.S. cannabis market, the recreational segment held about 66.9% of revenue in 2024, with medical use making up the rest. [7]Grand View Research

Other North America focused analyses similarly project adult-use to account for more than 80% of cannabis sales, with medical at ≈20%. [8]Cannabis Business Plans

Taken together, you can safely say:

Roughly two-thirds to four-fifths of legal cannabis sales are recreational / intoxicating, with only about one-fifth to one-third clearly attributed to medical programs.

Profitability and structural burden

Even with that big top line, the industry is struggling:

- Surveys from Whitney Economics show only about 27% of U.S. cannabis operators report being profitable in 2024. [9]PR Newswire+1

Heavy tax burdens (like IRS 280E), state excise taxes, licensing costs, and compliance overhead all eat into margins.

So while most marijuana volume and most marijuana dollars are about getting people high, the business environment is structurally expensive.

How do intoxicating hemp and marijuana actually compete in the market?

Now that we have the pieces, we can look at how these two worlds collide.

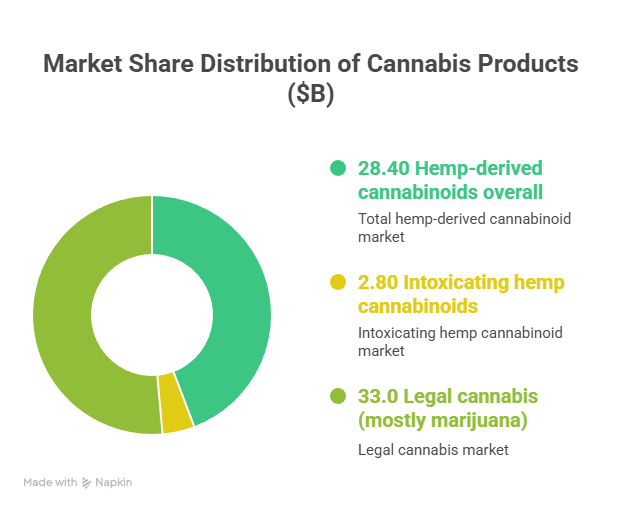

Relative size, simplified

- Hemp-derived cannabinoids overall ≈ $28.4B [2][10]Hemp Supporter+1

- Intoxicating hemp cannabinoids ≈ $2.8B [3]Cannabis Business Times

- Legal cannabis (mostly marijuana) ≈ $33B+ in recent years [5][6]CannabisMD TeleMed+1

So let’s cover that:

- On sales, intoxicating hemp is roughly one-twelfth the size of legal cannabis

- On biomass, intoxicating hemp probably represents about 1% of total hemp production

- Marijuana, in contrast, is majority intoxication by design, and the illicit side only tilts that further

Why marijuana operators feel threatened

Even though intoxicating hemp is a small slice in absolute terms, it has a few advantages in some states:

- Products can be sold in gas stations, vape shops, convenience stores instead of just licensed dispensaries

- In many jurisdictions, hemp cannabinoids do not face the same excise taxes and 280E restrictions

- Products can be shipped across state lines so long as they fit federal hemp definitions

- For the consumer, intoxicating hemp products often present as cheaper, easier to access, and “legal enough”

Policy work like the University of Illinois’ “High on Hemp” brief explicitly notes that hemp-derived THC products can divert some demand away from state-legal cannabis in markets like Illinois, because they are cheaper, less regulated, and more convenient, despite legal cannabis being available. [11]IGPA

Hemp is not bigger than marijuana… but in certain states, it can be the more convenient intoxicant for a slice of consumers.

The regulatory backlash

That competitive tension is why we see:

- 19 U.S. states banning or heavily restricting retail sales of hemp-derived cannabinoids, even as the national demand is measured in tens of billions. [2][10][11]Hemp Supporter+2Marijuana Moment+2

- Federal conversations about “closing the loophole” in the next Farm Bill, which could effectively wipe out much of the intoxicating hemp market, despite its size and employment footprint [3][4][12]Cato Institute+1

From the marijuana industry’s side, the argument is that hemp operators are selling THC without paying the same regulatory and tax costs. From the hemp side, the argument is that they are being targeted despite operating under the very federal law that Congress passed.

So how much of each plant is really about getting people high?

Putting the numbers into one clean comparison:

- Hemp (by biomass)

- ~75% of biomass is fiber, grain, or seed

- ~25% is floral

- Only a small fraction of that floral, maybe 3–5%, ends up in intoxicating products

- Net result: ≈1% of total hemp biomass is used to get people high

- Hemp (by dollars)

- Hemp-derived cannabinoids ≈ $28.4B

- Intoxicating hemp cannabinoids ≈ $2.8B

- Net result: ≈10% of hemp-derived cannabinoid dollars are from intoxicating products

- Marijuana (by dollars)

- Legal cannabis market ≈ $33B+

- Recreational share ≈ 67–80% of sales

- Net result: the majority of marijuana revenue is driven by intoxication-oriented use

Overall, the available data shows that intoxicating hemp products represent a much smaller share of total cannabinoid sales than marijuana and an even smaller share of overall hemp production. Most hemp biomass goes toward non-intoxicating uses, while most marijuana revenue comes from adult-use products.

At the same time, intoxicating hemp products can compete with regulated cannabis in certain states, particularly where marijuana is heavily taxed or limited, which can create localized financial impacts even if the national footprint is comparatively small.

These dynamics have contributed to ongoing policy discussions, as both industries operate under different regulatory frameworks and cost structures. Looking ahead, the numbers suggest that the two sectors function within the same broader cannabinoid marketplace, each serving different roles in supply, distribution, and consumer access rather than operating as direct replacements for one another.